lake county tax bill due dates

Worksite Prevention Protocol. School districts get the biggest portion about 69 percent.

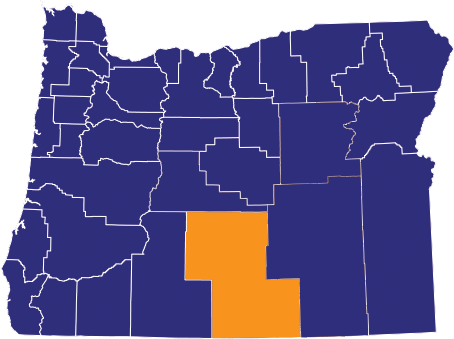

Sos Election Division Lake County Redistricting

Pay Your County Taxes Online A convenience fee will be charged by Lake County for each tax receipt paid with a credit card in accordance with Montana Codes Annotated 7-6-617.

. Electronic Payments can be. In accordance with 2017-21 Laws of Florida 119 Florida Statutes. Who do I contact if I disagree with the amount of my real estate tax bill and wish to put a hold on the APP until further research.

Check out your options for paying your property tax bill. Lake County property taxpayers receive their tax bill from the Lake County Treasurer in May with due dates in June and September. Mailed payments must be postmarked no later.

We ask that your district be cognizant of this and plan accordingly. Treasurers Office Policy for Pro-Rating Taxes. Select Tax Year on the right.

Lake County IL 18 N County Street Waukegan IL 60085 Phone. The June and September quarterly installments are based upon the prior years gross tax and any adjustments required after certification of the tax roll are made in the December and March quarterly installments. For your planning purposes the Lake County Clerks office will be closed on December 24 and December 27 2021 the two preceding business days.

2021 Taxes Payable in 2022. Main Street Crown Point IN 46307 Phone. Lake County does not receive any portion of this convenience fee.

SECOND INSTALLMENT OF REAL PROPERTY TAXES ARE DUE FEBRUARY 1 2022 AND WILL BE DELINQUENT IF NOT PAID BY APRIL 11 2022. THE LAKE COUNTY TREASURERS OFFICE IS OPEN TO THE GENERAL. Office of the Lake County Tax Collector 320 West Main Street Administrative Office 2nd Floor Suite B Tavares Florida 32778 Phone.

The tax offices are working in the 2020 year which corresponds to the property tax bill property owners will receive in early May of 2021. While taxpayers pay their property taxes to the Lake County Treasurer Lake County government only receives about seven percent of the average tax bill payment. Notice Of Real Estate Tax Due Dates Current Real Estate Tax Wednesday February 16 2022 Last Day of Payment of 1st Half of 2021 Taxes Wednesday July 20 2022 Last Day of Payment of 2nd Half of 2021 Taxes Notice is hereby given that Real Estate Taxes for the First Half of 2021 are due and payable on or before Wednesday February 16 2022.

This fee will be charged anytime a credit card is used when paying in person by phone or online. Sold Tax Lien Certificates. Due dates for property taxes are as follows.

1 For credit card payments 25 of your tax payment will be the convenience fee minimum fee of 200. Please understand that the Lake County Tax Offices operate on different years due to the Illinois property tax cycle taking place over a two-year timeframe. Offered by County of Lake Illinois treasurerlakecountyilgov 847-377-2323 PAY NOW With this online service you can search for your Lake County property tax bills and pay them online.

847-377-2000 Contact Us Parking and. These real estate taxes are collected on an annual basis by the Lake County Tax Collectors Office. Skip to Main Content.

NOTICE SECOND INSTALLMENT OF REAL PROPERTY TAXES ARE DUE FEBRUARY 1 2022 AND WILL BE DELINQUENT IF NOT PAID BY APRIL 11 2022. Property Tax Due Dates. Call Lake County Treasurers.

9 AM to 430 PM Levy for collection of taxes must be filed with our office on or before the last Tuesday in December in each year. Any amount remaining unpaid on April 1st is subject to all the provisions of law pertaining to delinquent real estate taxes. Mobile home due date.

The collection begins on November 1st for the current tax year of January through December. Access important payment information regarding payment options and payment due dates for property taxes. Lake County IL 18 N County Street Waukegan IL 60085 Phone.

Ad No Money To Pay IRS Back Tax. Mobile home penalty date - 25. Taxes paid online will be charged to.

Payments made online must be received by 5 pm MST on November 30 2021. Real Estate May 15th first half for all real estate October 15th second half for commercial and residential property November 15th second half for agricultural property. The Treasurer sends out tax bills and collects and distributes funds for all Lake County taxing districts.

Mailed payments must be postmarked no later than April 11 2022. Tax bills will be mailed. Two Harbors MN 55616 If you have any questions about how much is owed on your taxes please give us a call 218 834-8315.

2 For E-Checks the fee is 250 for tax amounts under 10000 and 1500 for tax amounts of 10000 or greater. Give less of your money to the government and keep more in your paycheck. Ad Is Your County of Lake Bill Due Soon Pay Your Bill Securely with doxo.

Ad Dave Ramseys tax advisors are redefining what it means to do your taxes right. IT IS THE RESPONSIBILITY OF EACH PROPERTY OWNER TO SEE THAT THEIR TAXES ARE PAID AND THAT THEY DO INDEED RECEIVE A TAX BILL.

Sos Election Division Lake County Redistricting

Sos Election Division Lake County Redistricting

Property Taxes Lake County Tax Collector

Follow Lake County News Sun S Newssun Latest Tweets Twitter

Clerkpay Online Court Payments

Oregon Judicial Department Lake Home Lake County Circuit Court State Of Oregon

Parking And Directions Lake County Il

Waste Hauling In Unincorporated Lake County Lake County Il

Property Taxes Will Increase In Lake County For Next Year